Why global-minded companies choose company formation offshore

Everything about the Advantages and Solutions Related to Company Formation Offshore for Business Owners

Offshore Company Formation provides a tactical alternative for business owners seeking to enhance their company procedures. It offers numerous advantages, consisting of tax optimization and enhanced privacy. Additionally, the process is sustained by specialized providers that simplify enrollment and conformity. Recognizing these benefits and the services readily available is essential for those considering this path. What details possibilities and challenges await business owners who venture into the offshore landscape?

Recognizing Offshore Company Formation

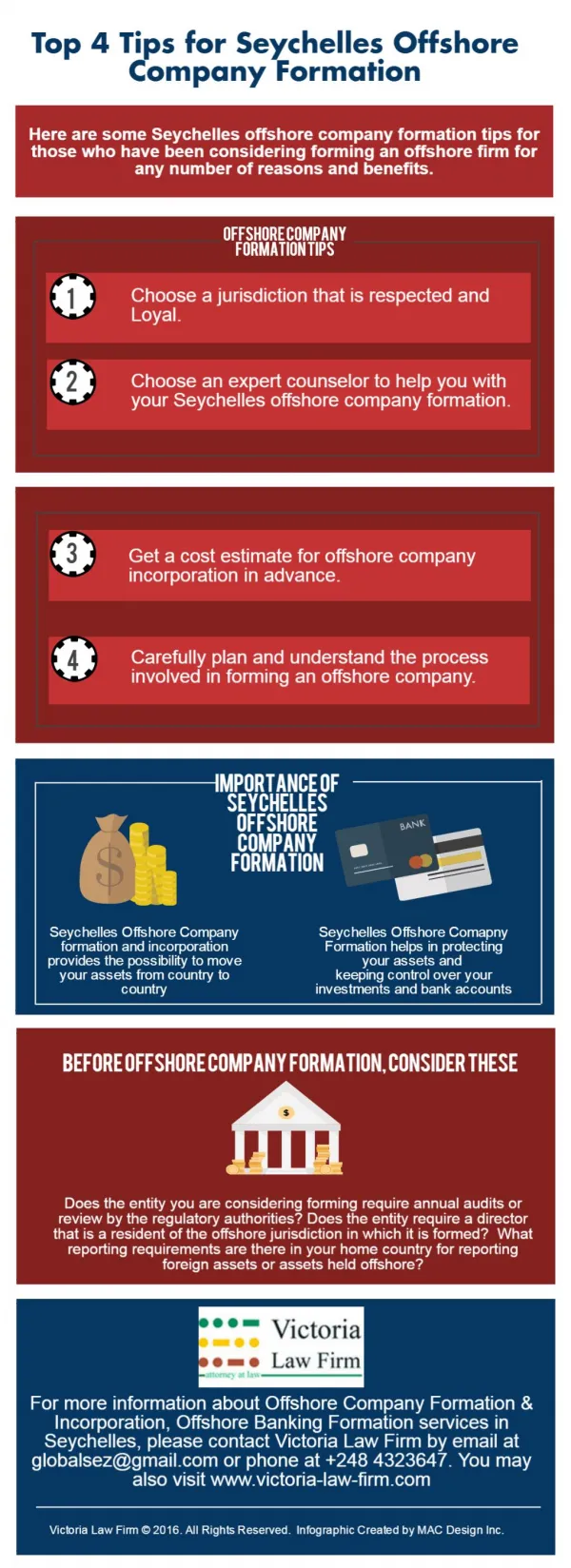

Lots of entrepreneurs look for possibilities to expand their organization perspectives, understanding overseas Company Formation is vital for navigating this complex procedure. Offshore Company Formation entails developing a business entity in a jurisdiction outside the entrepreneur's home country, commonly chosen for its positive governing environment and tax advantages. This procedure involves choosing the appropriate jurisdiction, which may differ based upon variables such as business goals, lawful implications, and financial security.

Entrepreneurs must also navigate the legal needs, including paperwork, registration, and conformity with local legislations. Furthermore, they ought to take into consideration the functional effects, such as company financial and the availability of professional services. A solid understanding of these components is essential, as they influence the total success of the offshore undertaking. Missteps in the development process can bring about economic setbacks or lawful problems, emphasizing the significance of complete research and professional support in this detailed landscape.

Trick Benefits of Establishing an Offshore Business

Establishing an offshore business offers significant advantages for entrepreneurs, especially in tax obligation optimization and asset protection. These advantages can improve financial versatility and secure personal riches from potential dangers. In this method, many entrepreneur consider overseas frameworks as a tactical relocation for long-lasting success.

Tax Obligation Optimization Strategies

Tax obligation optimization approaches with offshore Company Formation provide a compelling option when business owners look for to boost their monetary efficiency. Developing an offshore firm can lead to substantial tax obligation advantages, as many jurisdictions offer low or absolutely no company tax rates. This permits companies to preserve even more profits for reinvestment or distribution. Offshore entities can facilitate tax obligation deferment on earnings created outside their home nation, which can result in improved cash circulation. Business owners might likewise gain from streamlined tax obligation conformity, as some offshore territories have structured laws. Additionally, making use of tax obligation treaties can prevent dual tax, further enhancing total cost savings. By purposefully picking the right overseas location, business owners can successfully enhance their tax obligation responsibilities while maintaining conformity with international regulations.

Asset Protection Advantages

Establishing an offshore business provides significant property protection advantages that can protect entrepreneurs' individual and company assets from prospective risks. Offshore territories commonly give a higher level of personal privacy and privacy, making it testing for creditors or plaintiffs to accessibility delicate information. These territories often have positive legislations that shield against seizure and cases, enabling business owners to safeguard their riches successfully (company formation offshore). By separating individual properties from business responsibilities, business owners can minimize direct exposure to suits and economic risks. In addition, offshore business can help with asset diversity and protected investments in stable settings, additionally boosting security. Inevitably, these benefits develop a durable structure for entrepreneurs seeking to maintain their riches and assurance lasting economic security

Tax Advantages of Offshore Company Formation

One of the primary factors business owners think about overseas Company Formation is the possibility for substantial tax benefits. Many jurisdictions provide lowered tax prices or perhaps tax obligation exemptions for international business, enabling business owners to maintain more of their revenues. This can be specifically valuable for those operating in high-tax nations, as it enables them to lawfully minimize their tax responsibilities. By developing an overseas entity, entrepreneurs can additionally make the most of desirable tax treaties that may exist in between their home nation and the offshore location, further improving their tax effectiveness.

Furthermore, particular overseas territories do not enforce taxes on funding inheritances, gains, or dividends, making them appealing for lasting investment strategies. Overall, the critical use overseas firms for tax planning can result in better capital and boosted opportunities for reinvestment, inevitably adding to company development and sustainability.

Improved Privacy and Possession Security

Exactly how can business owners guard their possessions while taking pleasure in higher personal privacy? Offshore Company Formation uses a tactical remedy. By establishing an organization in territories recognized for strong discretion legislations, entrepreneurs can efficiently shield their monetary and individual information from public examination. These jurisdictions frequently provide limited disclosure requirements, permitting proprietors to continue to be anonymous.

Moreover, overseas business can produce a lawful barrier between personal assets and service responsibilities. This separation boosts possession security, making it harder for lenders to pursue personal assets in case of a business conflict. In addition, certain territories use robust lawful frameworks that prevent the seizure of properties, additionally securing entrepreneurs' investments.

In this way, improved personal privacy and asset security not just offer comfort but also promote a setting where entrepreneurs can run without the consistent danger of breach or financial direct exposure. Eventually, this calculated approach enables entrepreneurs to concentrate on growth and development.

Accessibility to Global Markets and Organization Opportunities

Offshore Company Formation not just boosts privacy and property protection however additionally opens up doors to global markets and varied service possibilities. Entrepreneurs can take advantage of numerous jurisdictions that supply positive governing settings, allowing them to gain access to clients and providers worldwide. This globalization cultivates affordable advantages, allowing businesses to adapt rapidly to market needs and take advantage of arising patterns.

Solutions Provided by Offshore Company Formation Companies

While passing through the complexities of establishing an organization abroad, entrepreneurs often count best site on the competence of overseas Company Formation companies. These providers provide a series of important services designed to streamline the process of establishing a firm in foreign territories. Trick solutions typically consist of firm registration, which includes steering local laws and regulations to ensure compliance. In addition, they aid with acquiring necessary licenses and permits, giving lawful assistance that assists business owners the original source recognize the ins and outs of international service laws.

Furthermore, offshore Company Formation suppliers often use banking solutions, aiding in the facility of offshore accounts to assist in monetary deals. They may additionally give online workplace services, granting services a professional address and communication services without the requirement for physical presence. Lastly, these service providers frequently provide ongoing management assistance, ensuring that the firm continues to be certified with regional laws and helping with smooth operations in the worldwide market.

Steps to Successfully Develop an Offshore Company

Developing an overseas business calls for a systematic strategy to navigate the numerous legal and administrative difficulties. The primary step includes picking the appropriate territory that straightens with business's objectives and regulative needs. Next, entrepreneurs have to select an ideal firm framework, such as a minimal responsibility firm or a worldwide business firm.

After establishing the structure, the necessary documentation needs to be prepared, consisting of write-ups of incorporation and recognition papers. Engaging a reliable overseas service company can improve this process and warranty compliance with regional regulations.

When the papers are submitted, business owners need to open up a checking account in the selected territory, which is important for carrying out business transactions. Lastly, securing any type of required licenses or licenses is essential to run lawfully. By adhering to these steps diligently, entrepreneurs can successfully establish an overseas company that facilitates their organization goals while reducing tax obligations and regulatory concerns.

Often Asked Questions

What Are the Usual Misconceptions About Offshore Companies?

Typical false impressions concerning offshore companies include ideas that they are exclusively for tax evasion, lack transparency, or are prohibited. Lots of people overlook the legit advantages, such as possession security, personal privacy, and global market accessibility.

Exactly how to Pick the Right Offshore Jurisdiction?

Picking the right offshore territory includes assessing factors such as tax advantages, regulatory environment, political stability, and personal privacy laws. Entrepreneurs should perform comprehensive research and seek professional suggestions to guarantee alignment with their service objectives and needs.

Can I Run an Offshore Business From My Home Nation?

Operating an overseas company from one's home nation is feasible, provided neighborhood legislations permit such activities - company formation offshore. Business owners need go to my blog to ensure conformity with laws to prevent lawful difficulties, while maximizing the advantages of offshore Company Formation

What Are the Ongoing Conformity Requirements for Offshore Firms?

Recurring compliance demands for offshore companies typically include annual filings, preserving precise records, and sticking to local guidelines. These commitments vary by territory, requiring mindful attention to ensure ongoing legal standing and operational authenticity.

Just How Do Money Exchange Rates Affect Offshore Services?

Currency exchange rates substantially impact offshore companies by influencing functional prices, rates strategies, and earnings margins. Changes can impact competition in international markets, requiring companies to adjust their economic strategies to minimize prospective risks.

Offshore Company Formation offers a critical choice for business owners seeking to enhance their business procedures. Offshore Company Formation involves establishing an organization entity in a territory outside the entrepreneur's home nation, typically picked for its desirable regulatory atmosphere and tax advantages. Establishing an overseas company provides substantial property protection benefits that can protect entrepreneurs' individual and company assets from prospective dangers. While going across the intricacies of establishing a service abroad, entrepreneurs often depend on the know-how of offshore Company Formation service providers. Offshore Company Formation service providers commonly provide financial solutions, aiding in the facility of offshore accounts to assist in economic transactions.